In an era dominated by flashy headlines and viral market chatter, it can be tempting to chase the next big thing. Yet true investing success comes from a deliberate strategy rather than fleeting trends. By focusing on compound growth over decades and aligning every choice with how long you plan to stay invested, you build a resilient portfolio that weathers storms and harnesses opportunity.

Rather than being swayed by hype cycles or celebrity endorsements, you can achieve lasting results by letting your personal goals define your path. This article explores why the investment time horizon should be your guiding star, and how to tailor your approach for short, medium, and long-term objectives.

The term investment time horizon refers to the length of time an investor expects to hold an asset before needing to access the funds. This concept is foundational because it dictates the level of volatility you can endure and determines which vehicles best suit your goals. Before diving into assets, map out when you will require your capital.

For some, the horizon is just a few years—saving for a down payment or a dream vacation. For others, it spans decades—building retirement wealth or funding a child’s education. Recognizing that each goal has its own schedule allows you to assign the right instruments and appropriate risk levels, rather than lumping all resources into one undifferentiated pot.

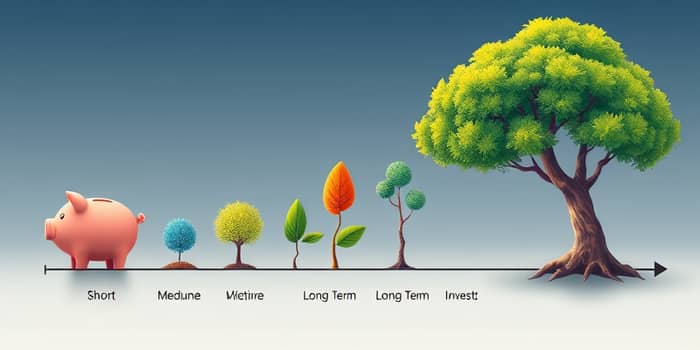

Investors generally categorize objectives into three main buckets: short-term, medium-term, and long-term. Each segment requires a unique blend of assets to balance growth potential and risk exposure. The table below illustrates these horizons and typical choices for each.

For a short window, preservation takes priority. Medium-length goals blend growth with safety. Meanwhile, long horizons maximize equity exposure to ride out downturns and capture market upswings.

Adjust these allocations as you approach each maturity date, shifting from equities toward fixed income to secure gains and protect capital.

Generally, the longer you commit funds, the more risk you can assume because downturns are temporary on a multi-year scale. Historical data shows the S&P 500 delivered an average annual return of 11.97% from 2010 to 2022, while the peak US Treasury yield during that period was merely 3.83%.

By allocating more toward equities for long-term growth potential, you capitalize on higher expected returns and allow recovering from market dips. Fixing an incorrect risk mix for your horizon can jeopardize your plan: too much equity in the short-term exposes you to potential losses with no time to recover, while too little equity for long goals risks underperforming inflation.

Medium-horizon strategies often aim for balance risk and return through a diversified portfolio—enough stocks to fuel growth but a substantial bond cushion to smooth volatility.

Panic and impulsive decisions driven by market buzz can derail even the most carefully laid plans. Remain vigilant against noise and focus on fundamentals. Here are frequent mistakes:

Resist the temptation to overhaul your portfolio at the hint of a headline. Instead, stick to your strategy and rebalance on a predetermined schedule.

Effective alignment begins with clear objectives and precise timelines. List each goal and assign an expected date for the funds. Then, determine an allocation consistent with your time frame—typically:

Periodically review performance and rebalance back to target weights—this disciplined rebalancing schedule for your portfolio ensures you buy low and sell high over market cycles. In addition, account for inflation: for horizons exceeding a decade, equities are often your best hedge against rising costs.

Echoing Warren Buffett’s wisdom, ignore fleeting swings and focus on multi-year returns. True risk lies not in volatility, but in failing to outpace inflation and capture growth.

Transform planning into action with these concrete steps:

By following this roadmap, you cultivate a resilient framework that stands firm amid market shifts and capitalizes on long-term opportunities.

Investing according to your time horizon rather than chasing hype offers clarity, discipline, and a higher probability of success. By customizing asset allocation, staying the course through volatility, and rebalancing with purpose, you honor both your immediate needs and future aspirations.

Embrace this horizon-centric mindset to transform investment uncertainty into a structured journey toward financial goals—where patience and principled strategies drive enduring prosperity.

References