Managing speculative investments demands both boldness and restraint. By applying a disciplined framework, you can harness opportunities without jeopardizing your financial future.

Speculative holdings are assets acquired for their potential for outsized returns through price swings rather than their fundamental performance. They often exhibit extreme volatility and carry a high risk of loss.

Common speculative vehicles include:

Unlike dividend-paying stocks or rental real estate, these assets do not generate income while held, making timing and risk controls crucial.

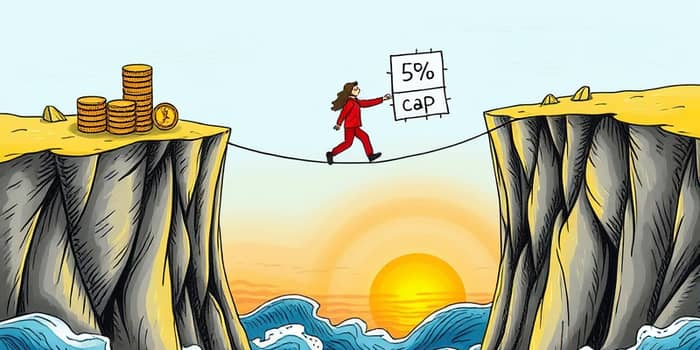

While speculation can fuel your portfolio’s upside, it also amplifies downside. A strict cap acts as a protective boundary against catastrophic losses.

Consider that unbridled enthusiasm led to historic episodes of ruinous asset bubbles. By confining risk-taking, you ensure the rest of your portfolio remains stable and growth-oriented.

Most experts recommend limiting speculative holdings to no more than 5% of your total investable assets. This isolates risk-taking to a controlled sandbox and safeguards your primary wealth drivers.

Organize your portfolio into two distinct buckets: a core comprised of stable, income-producing investments, and a speculative satellite for high-risk opportunities.

To enforce your cap:

By adhering to these rules, you can explore bold ideas without endangering your core holdings.

The cryptocurrency surge and meme-stock rallies illustrate both the heights and perils of speculation. Participants often experienced rapid gains but also severe losses when the tide turned.

In 2021, novice traders rode the GameStop wave, only to see valuations evaporate within days. Yet in the same era, early capital into a handful of blockchain startups created industry leaders.

These contrasting outcomes underscore two truths: bubbles can form rapidly, and sagacious investors can still back transformative ventures responsibly.

Speculative capital plays an essential role in funding breakthrough ideas. It fuels research, drives novel technologies, and nurtures tomorrow’s blue-chip firms.

Striking the right balance means committing funds to experimentation while maintaining a solid foundation of reliable assets.

Speculative investments can be exhilarating and potentially lucrative, but they must never undermine your long-term objectives. By imposing a strict cap, you control downside and empower yourself to take calculated risks.

Remember to regularly review and rebalance your positions, keep speculation within its designated bucket, and continually educate yourself on evolving market dynamics. This disciplined framework lets you pursue high-reward ideas responsibly, ensuring your financial future remains bright.

References