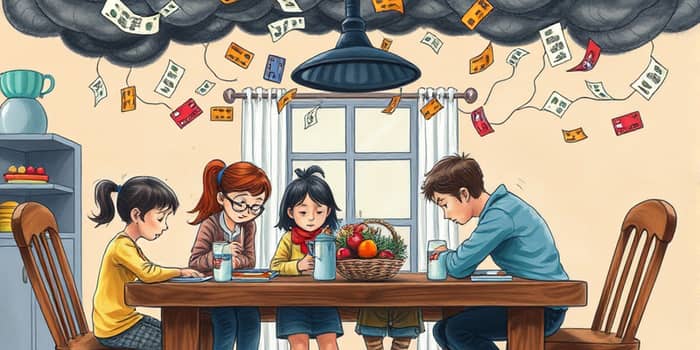

In the face of tight budgets and rising costs, many households turn to revolving credit as a lifeline. Yet, without careful management, it becomes a sinkhole for savings and peace of mind.

Revolving debt offers a flexible borrowing option, but this very flexibility can mask serious pitfalls. Understanding its mechanics and hidden costs is essential to safeguard financial health in difficult economic times.

Revolving debt differs fundamentally from installment loans. Instead of a fixed repayment schedule, it allows continuous borrowing up to a preset credit limit. Credit cards, home equity lines of credit, and overdraft protection are typical examples.

Interest accrues only on the outstanding balance, but these rates are often variable and often high interest rates, leaving borrowers vulnerable to rapid cost increases. The lack of a defined payoff date means balances can linger indefinitely.

As of the end of 2023, U.S. revolving credit skyrocketed past $1.3 trillion, making up over 25% of all consumer credit. By September 2024, the average household carried $10,563 in credit card debt, with many living paycheck to paycheck holding even more.

In periods of inflation or recession, essentials like food, housing, and transport climb faster than incomes—up 27%, 26%, and 28% respectively since 2019, while median earnings rose just 21%. Nearly half of revolvers tapped credit for necessities, not luxuries.

If only minimum payments are made, the mathematics becomes grim. On the average debt of $10,563 at a 21.4% APR, total repayments can reach $28,683, almost triple the principal. High fees compound the burden—U.S. credit card revolvers paid $111 billion in 2021 alone.

The combination of skyrocketing interest rates and fees and an undefined payoff timeline traps many in a deepening cycle.

Persistent revolving debt drains emergency savings and monopolizes credit lines, leaving little room for unexpected expenses or smarter financing options with lower rates. Damaged credit scores further raise borrowing costs and narrow future options.

Borrowers often hope higher future income will erase their balances—yet 30% of indebted Americans expect to clear debts with increased earnings, despite no correlation between optimism and ability to pay down.

Consumers can take proactive steps to regain control. Start by creating a clear budget and tracking monthly spending to pinpoint areas for trimming. Prioritize paying more than the minimum to chip away at principal balances.

Consider consolidating high-rate cards into a lower-interest personal loan or balance transfer offer. Negotiating with card issuers for reduced rates or enrolling in hardship programs can also yield relief.

On a broader scale, policymakers have introduced measures to increase transparency—requiring detailed minimum payment disclosures and promoting automated repayment acceleration. These efforts aim to shorten protracted debt periods and boost consumer liquidity.

Living within means is crucial. Establish an emergency fund equal to 3–6 months of living expenses. Automate savings to build this cushion steadily, reducing reliance on revolving credit when unplanned costs arise.

Adopt a debt repayment strategy—such as the avalanche method (targeting highest APR first) or the snowball method (starting with smallest balance)—to maintain motivation and momentum.

Seek professional advice if debt feels overwhelming. Credit counseling agencies offer free or low-cost guidance to develop personalized repayment plans and negotiate with creditors.

Revolving debt can provide vital breathing room during financial strain, but without disciplined management, it becomes a perilous burden. By understanding its mechanics, recognizing the hidden costs, and adopting deliberate repayment strategies, households can break the cycle and restore control.

Empowerment comes from knowledge and action. Equip yourself with a budget, build emergency savings, and attack high-interest debts first. In doing so, you’ll transform a potential financial trap into a stepping stone toward long-term stability and peace of mind.

References